40, 50, 60, 70 week lead times! Talk to us.

In comparison to our competitors, we offer relatively short lead times and in areas where that is not possible, stocking agreements are put in place to support the production schedule. Our proactive and predictive steps are paying dividends to existing and new customers. In 90% or more of cases where new or existing clients are struggling with sourcing we have not only delivered quicker, but offered cost saving and in some cases better quality units with longer warranties.

Of course, we are not completely immune to what is happening on the global stage and a few products have become EOL or on long lead times, but this is only the story in a handful of examples. In situations like this, communication is key to work with the requirements of clients by facilitating stock management to keep production programs rolling. We offer dynamic stocking agreements based on the projection of throughput, which is only possible with continuous communication with customers. In these agreements a PO covers the period (18 months or so) and invoices are only issued for units delivered to assist cash flow.

Over the last year lead times have been affected by many contributing factors at various bottle necks; component shortages, labour shortages, trade embargos, IOT device demands, crypto mining demands (now dropped off), droughts in Taiwan (affecting ultra vapour production for chip manufacture), transportation challenges (ports filling up with empty containers) and it has been very challenging for us and our customers to react to these issues best we can.

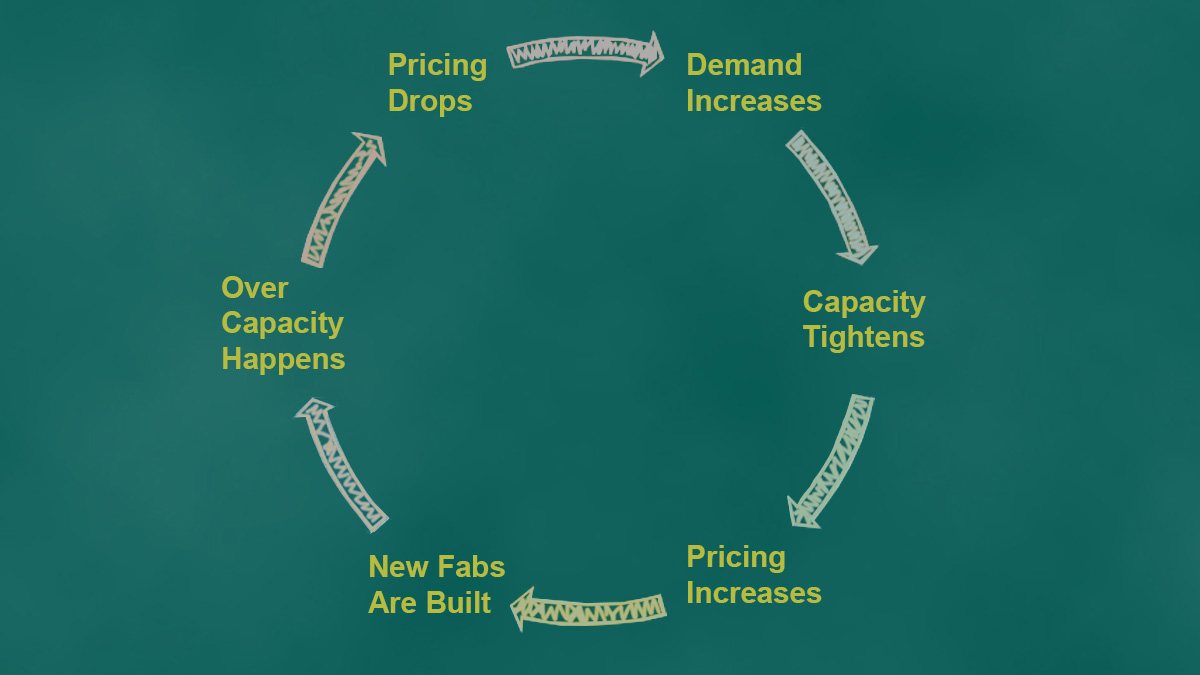

The supply of ICs has been particularly an issue. ST-micro orders will continue to exceed capacity and they are not alone. The demand for ICs has been rising and large fab investments have not been made. The chip manufacturers will only invest in new machinery when there are sufficient and continued projections of demand of the certain size of wafer. Whilst machines can be reconfigured to different sizes it is expensive and takes a long time to do, so the manufacturers must be sure that their investments of time and money will pay off.

The lack of ICs has resulted in goods manufacturers wanting to secure resources by bringing them in house or close partnerships that involve customisation. VW announced that it would manufacture its own IC variants with ST-micro and the Taiwan Semiconductor Manufacturing Company are set to produce them. The TSMC has 56% foundry market share, manufacturing for Apple and is a strong partner to choose for the job. This then gives the plant the confidence in allocating resources to produce the chips.

These seasonal demands can be predicted to a degree and many of our manufacturing partners had the foresight to get ahead of the shortage with some stock piling, but the duration of the shortage exacerbated by other factors resulted in a “perfect storm”. Seeing this coming early moves, to find alternatives where possible, rigorous testing and re-approving where necessary has kept things moving. Not all changes to power supplies require safety approval updates and this escalation is generally limited to critical components and board layout changes. Where this has occurred, in order to update the safety approvals with the alternative components nationally recognised test houses (EMTEK, UL, Intertek, TUV etc) are required to certify the safety approval. With many power supply and device manufacturers needing to do this to continue to satisfy demand, the queue has been out the door.

If you need a new source or a reliable second source of power conversion or battery solutions contact us